Ethereum Price Prediction: $4,500 in Sight as Bullish Factors Align

#ETH

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge as ETH Tests Key Levels

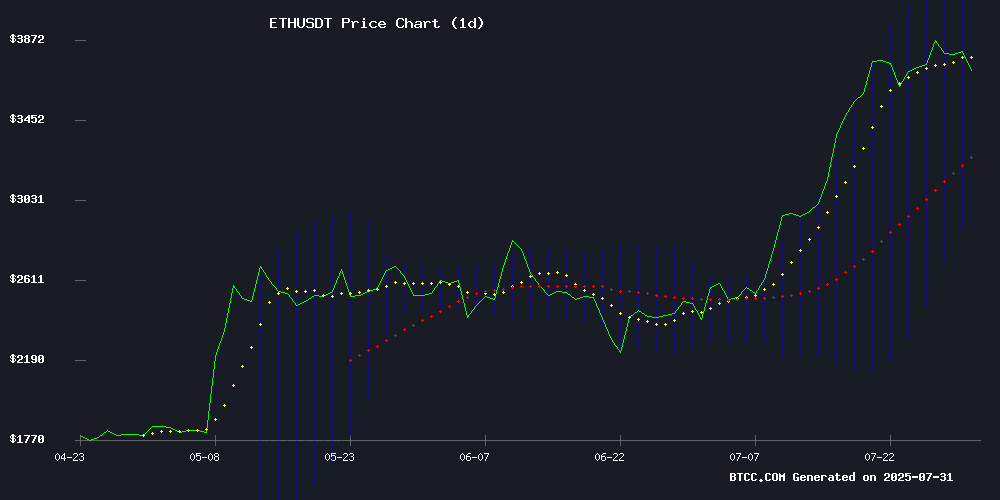

ETH is currently trading at $3,861.51, showing strength above its 20-day moving average of $3,562.84. The MACD histogram has turned positive at +62.39, suggesting building bullish momentum. Prices are testing the middle Bollinger Band at $3,562.84, with potential to challenge the upper band at $4,164.41 if buying pressure continues.

"The technical setup shows ETH is consolidating after its strong July rally," said BTCC financial analyst Emma. "A decisive break above $4,000 could open the path to $4,500 as the next major resistance level."

Regulatory Clarity and Institutional Adoption Fuel Ethereum Optimism

Positive regulatory developments and growing institutional interest are creating a favorable environment for Ethereum. The DOJ clearing Dragonfly in the Tornado Cash case and eToro's launch of ethereum tokenized stocks highlight increasing mainstream acceptance.

"The combination of regulatory clarity and major firms like 180 adopting Ethereum strategies is driving fundamental strength," noted BTCC's Emma. "While short-term volatility may occur, the long-term trajectory appears bullish with the $4K psychological level as the next target."

Factors Influencing ETH's Price

ETH Price Surges to $3,859 as Regulatory Clarity Fuels 54% July Rally

Ethereum's price surged to $3,859.74, marking a 1.33% gain in 24 hours, as regulatory clarity from the GENIUS Act and institutional ETF inflows propelled a 54% rally in July. The overbought RSI at 77.16 signals potential volatility ahead.

The GENIUS Act, signed into law on July 25, has bolstered confidence in Ethereum's ecosystem by providing clear stablecoin oversight. This legislative milestone, coupled with PayPal's global crypto payment launch, has amplified institutional demand and mainstream adoption.

Despite the bullish momentum, concerns from the European Central Bank about U.S. dollar-backed stablecoins and a brief 3% correction on July 24 underscore the market's inherent volatility. Institutional inflows remain robust, but traders should heed overbought conditions.

Life Sciences Firm 180 Shifts to Ethereum Strategy with $425M Funding, Rebrands as ETHZilla

180 Life Sciences Corp. (NASDAQ: ATNF) has pivoted from biotechnology to cryptocurrency in one of the most significant corporate shifts into digital assets. The company secured $425 million in a private placement to build an Ethereum treasury strategy and will rebrand as ETHZilla Corporation.

Proceeds will primarily fund Ether (ETH) purchases, marking a stark departure from its former focus on inflammatory disease therapeutics. The PIPE deal priced shares at $2.65, attracting over 60 institutional investors including Electric Capital, Polychain Capital, and founders of major DeFi protocols like Lido and Compound.

The move coincides with Ethereum's 10th anniversary, with ETHZilla positioning itself as a NASDAQ-listed treasury vehicle for ETH. 'We're rewriting the rules of programmable finance,' the company tweeted ahead of its ticker symbol change to $ATNF.

Etherex Aims to Realize Ethereum's Original DEX Vision on Linea

Etherex, a newly launched decentralized exchange on Linea, seeks to fulfill Ethereum's foundational promise of user-aligned decentralized infrastructure. The platform returns all trading fees and incentives to locked token holders, positioning itself as a potential magnet for institutional ETH capital seeking superior yields.

The project draws inspiration from Ethereum's 2014 EtherEX concept while building upon innovations by Uniswap, Curve, and Aerodrome. Its launch coincides with Linea's Ethereum layer-2 token announcement, marking a strategic alignment with Ethereum mainnet.

DOJ Clears Dragonfly in Tornado Cash Case as Storm Trial Nears End

The U.S. Department of Justice has confirmed Dragonfly Capital is not a target in its investigation into Tornado Cash co-founder Roman Storm. Managing partner Haseeb Qureshi revealed federal prosecutors made the rare public disclosure during Storm's money laundering trial in Manhattan.

Storm faces charges of processing over $1 billion in illicit funds through the Ethereum-based privacy tool, including transactions tied to North Korea's Lazarus Group. The 2019 open-source protocol was sanctioned by the U.S. Treasury in 2022—marking the first time a software project received such designation.

Blockchain forensic experts and former Tornado Cash users have testified in the landmark case, which began July 14. Closing arguments are expected this week as the crypto industry watches closely for precedent-setting implications.

Tornado Cash Trial Reaches Jury Deliberation Phase

The fate of Tornado Cash developer Roman Storm now rests with jurors after closing arguments concluded in Manhattan federal court. Prosecutors framed the privacy tool as a criminal profit center, while defense attorneys maintained its legitimate purpose for financial anonymity.

Government attorneys spent 45 minutes rebutting defense claims, presenting internal messages allegedly showing Storm's awareness of illicit use. 'This wasn't privacy - this was profit,' argued prosecutor Nathan Rehn, dismissing the defense's characterization of Tornado Cash as neutral technology.

Storm's legal team conceded criminals exploited the mixer but emphasized its original design for legitimate privacy needs. 'The existence of misuse doesn't equate to intent,' defense attorney David Patton told jurors in his summation.

eToro Bridges Wall Street and Web3 with Ethereum Tokenized Stocks and 24/5 Trading

eToro is accelerating the convergence of traditional finance and crypto with two landmark innovations. The trading platform will tokenize over 100 U.S. stocks and ETFs as ERC-20 tokens on Ethereum, each backed 1:1 by real shares held in regulated custody. This move expands on eToro's earlier tokenization of precious metals through its Firmo acquisition.

Simultaneously, eToro introduces 24/5 trading for U.S. equities, granting retail investors near-continuous access previously reserved for institutions. The Ethereum-based tokenized assets promise blockchain transparency while maintaining seamless convertibility with traditional positions through eToro's platform.

Jury Deliberations Begin in Tornado Cash Developer Roman Storm's Money Laundering Trial

Manhattan jurors are now deliberating whether Tornado Cash co-founder Roman Storm facilitated the laundering of over $1 billion for cybercriminals, including North Korean hackers. Prosecutors allege Storm ignored victim pleas while maintaining control of the platform's interface—a claim the defense disputes.

The trial's closing arguments hinged on Tornado Cash's immutable smart contracts versus its mutable front-end. While both sides agreed the mixing pools couldn't be altered, prosecutors emphasized Storm's team could have modified access points to curb illicit activity.

Ethereum Turns 10: What's Coming in the Next Decade?

Ethereum marked its 10th anniversary this week, surviving a decade of existential threats and transformative upgrades. The network, now the second-largest cryptocurrency by market cap, has evolved from its proof-of-work origins to a proof-of-stake model through "the merge." Layer-2 scaling solutions and interoperability improvements have become central to its growth.

Over the next decade, Ethereum advocates predict it will solidify its role as the "settlement layer for everything." Consensys dismissed quantum computing concerns, asserting the community is prepared for future challenges. The network's trajectory suggests continued dominance in decentralized finance, NFTs, and beyond.

Ethereum (ETH) Price Prediction: ETF Redemptions Fuel Liquidity as $4K Breakout Looms

Ethereum's bullish momentum continues to build, with the cryptocurrency trading near $3,827 amid a 3.61% weekly gain. Institutional demand through Ethereum ETFs is driving capital inflows, pushing 24-hour trading volume above $36 billion. A decisive breakout above the $3,900 resistance level could trigger liquidations of $1.4 billion in short positions, potentially propelling ETH toward the psychologically critical $4,000 mark.

Technical indicators and on-chain fundamentals suggest growing strength across both retail and institutional markets. The liquidity landscape is being reshaped by ETF activity, creating favorable conditions for upward price movement. Market participants are closely monitoring the $3,884 daily high as a precursor to more significant gains.

Polygon Foundation Links Network Outage to 'Validator Exit'

Polygon's consensus layer experienced a temporary disruption after a validator exit triggered an unexpected bug, halting Heimdall, the network's validation layer, for over an hour. While Bor, Polygon's proof-of-stake chain, continued producing blocks, user-facing services faced delays.

The Polygon Foundation acknowledged the incident in a since-deleted post on X, later replacing it with a more detailed statement. Services were not fully restored as of 3 p.m. ET, with the team collaborating to resolve remaining issues. The outage follows a technically complex upgrade earlier this month, raising questions about network stability during validator transitions.

Ethereum's Bullish Momentum Faces Key Resistance Test

Prediction markets now assign a 63.6% probability to Ethereum surpassing its $4,891 all-time high before 2025 closes, fueled by a 58% July rally that pushed ETH to $3,780. The surge coincides with institutional accumulation—billion-dollar buy orders suggest growing conviction in ETH's value proposition.

Technical barriers loom large, however. Ethereum has faced rejection at the $4,000 level ten times since 2021, creating a formidable supply zone. Market structure analysis reveals critical divergence between spot demand and derivative positioning that could dictate near-term price action.

How High Will ETH Price Go?

Based on current technicals and market sentiment, ETH has strong potential to reach $4,500 in the coming months. Key factors supporting this prediction include:

| Factor | Impact |

|---|---|

| Technical Breakout | MACD turning positive, price above 20MA |

| Regulatory Clarity | Reduced uncertainty after Tornado Cash case |

| Institutional Adoption | $425M funding for ETH-focused strategies |

| Market Sentiment | 54% July rally creating bullish momentum |

"The $4,000 level remains crucial," emphasized BTCC's Emma. "A weekly close above this resistance could accelerate gains toward our $4,500 target, with $3,500 acting as strong support."

- Technical indicators show ETH building bullish momentum above key moving averages

- Regulatory developments and institutional adoption are creating fundamental support

- Market sentiment remains positive after July's 54% rally